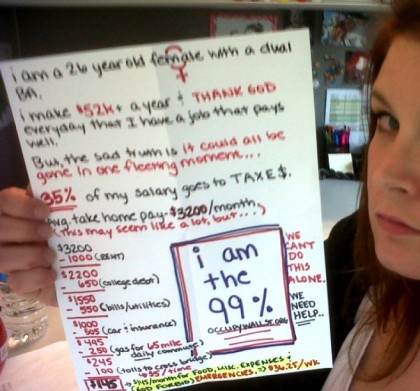

You’d think this entitled and ridiculous lot was the first generation of Americans to get out into the real world and find out the going isn’t as easy as it was with mom and pop taking care of you. Just looking at her expenses:

You’d think this entitled and ridiculous lot was the first generation of Americans to get out into the real world and find out the going isn’t as easy as it was with mom and pop taking care of you. Just looking at her expenses:

- She went into way too much debt in college if that’s what she’s paying in student loans. I can sympathize, since I did the same thing. But I spent the first few years out of college living with my dad and paying down the loans until I got them to a reasonable level to refinance them.

- 550 is about what I pay in utilities for a house with two people living it… if I count as a “utility” an iPhone plan and high speed internet. Actually, I don’t think I hit 550 with even that. She must have a nice cable package too.

- She pretty clearly has a new car if she’s paying 505 a month. My insurance is about 100 a month. I don’t have a car payment because I paid it off several years ago. Maybe she doesn’t really need a new car? I’ve bought cars for 3000 in cash that have run for years afterwards.

- Her commute is 65 miles? Jesus! I draw my boundary at 50, and my earning potential is about twice hers. Maybe move closer to your job? Not like you have to sell a house and cover a mortgage or anything.

Just not feeling the sympathy. Who I do feel sympathy for in this generation are the kids who graduated from college and can’t find jobs, because the economy isn’t producing any for them. It’s been several graduating classes now that have hit the job market during this financial crisis, and unemployment among young people is sky high.

But even there, they voted for Obama in large numbers, and his health care fiasco is a big reason companies are reluctant to hire right now, because all anyone knows about it is that it’s definitely going to be expensive, and probably a lot more expensive than anyone really thinks. How’s that hope and change working out for you now?

We need to send Dave Ramsey to Wall Street.

I’ve had this argument about bills with the liberals in my family for years. My best example is an aunt who can’t afford health insurance. She can afford an expensive Volvo that gets upgraded every time it gets paid off and an iPhone and every TV channel, but not a cheapo health insurance plan. I’m a full time college student (engineering major, senior year) and a full time restaurant server (all tips declared), I have no help from parents, no revolving debt, and I’m not the 99%

1) she needs to get a roommate or a boyfriend (or girlfriend) to help support her with rent or a place to stay

2) Ditch the car and move closer

3) learn to brown bag your lunch and eat out less.

4) utilities and bills is a broad category and could including anything, including credit cards

5) the amount she is paying per month is quite high and suggests she is paying on her debt faster to minimize interest expense. While I applaud that, perhaps selecting a more graduated payment system will help?

I have no sympathy. I graduated with $130,000 in student loans between college and law school 15 yrs. ago. I have my student loans locked in at 3% and am still paying them ($62k to go), but I earn more on my 401k and other investments to pay them back faster when they get nothing if I croak. I still own and use the first stereo I got at age 15 (25 yrs ago). I still own and wear a pair of dress shoes I got 22 yrs ago. I drive an 8 yr old vehicle and make it work so my wife can stay at home with out children. I jsut replaced a 8 yr old Dell computer that had a disk drive making the sound of a jet engine taking off. I DO NOT OWN AN iPHONE, A MAC or ANY APPLE PRODUCTS. How about you occupiers make freaking do with what you got and bitch and moan about gov’t waste???

Single, $52K per year and she’s whining? Poor baby. I know whole families who are eating, keeping a roof over their heads, and clothing everyone for a lot less than that.

She has a spending problem and can’t seem to figure out that she should move closer to work.

So why are we sitting around “proving” they’re wrong?

These Fifth Columnists are guilty of TREASON. It’s past time to clear our cities of these trash. There are what, a few thousand of these vermin and 100 million gun owners?

Show some balls and exercise your duties as the Unorganized Militia of the United States by putting down this treasonous revolt.

Single, $52K per year and she’s whining? Poor baby. I know whole families who are eating, keeping a roof over their heads, and clothing everyone for a lot less than that.

Indeed.

That says it all.

What revolt? They are just being bums. It’s not like they are shooting anyone. I don’t agree with them, but I believe they have a right to protest.

At $52k/yr, she’s earning more than the average HOUSEHOLD in the US, which recent numbers put at $49k and change.

Some articles citing this:

* http://www.gobankingrates.com/post-recession-median-u-s-household-income-continues-to-fall/

* http://www.suntimes.com/business/8144637-420/median-income-has-shrunk-faster-since-recession-ended.html

* http://latimesblogs.latimes.com/money_co/2011/10/household-income-fell-recovery.html

Census Bureau Figures:

* In 2010, the median personal income in the entire US was $26,197 (http://www.census.gov/hhes/www/cpstables/032011/perinc/new01_001.htm)

* In 2010, the median household income in the entire US was $49,445

That means, by herself, she’s making twice as much as the average worker, and a bit over the average household (with 2 workers). The help she needs is a good financial planner, not a government bailout.

They have already stated their intent to overthrow the US government and establish a Communist state. That’s insurrection, which is within the definition of treason, which is a capital offense.

Oh please with the treason bullshit….

“Treason against the United States, shall consist only in levying War against them, or in adhering to their Enemies, giving them Aid and Comfort.”

They are occupying our cities. That constitutes war.

kenno271 – You’re advocating the murder of people you disagree with. Thats not exactly the American way either.

Not murder. There would be due process.

Besides, it isn’t illegal to “not follow the American way.” It is illegal to commit treason. So fine, say I’m un-American, but enforce the law against the Fifth Column.

1 – 35% of what she makes goes to taxes – hmmm…I think a heck of a lot of conservatives/libertarians don’t like taxes in general…? Now let’s say taxes are gone…

2 – Some of it is situation, and some of it really is their own fault. I bet she has some legit reasons why things cost so much for her.

3 – Kenno – I disagree with your sentiment here. There is no armed threat from the “Occupy Whatever” group. Now if they somehow managed to obtain weapons and start looting and trashing and shooting up the place I think that is probably an armed insurrection right there. But all they’re doing is exercising their First Amendment rights – something we all swore to protect, not just the 2nd Amendment alone.

Treason is a very specific offense, and this doesn’t even come close.

I made less than her, and I can tell automatically she’s made some poor choices in the automotive department. You know how I survived? Budgeting. I sold the GTO. That helped tremendously. Driving habits, where i lived (I moved closer to work), and I made it work to where I had somewhere like 25% of my take home pay left. Budgeting. People forget they can make lifestyle changes, and when the accounts don’t balance, you don’t march off to Wall Street and demand someone change the external forces to suit your needs.

My biggest question however, is that if 35% of your money is taken by taxes, why occupy Wall Street? You’re in the wrong city.

My response: http://www.exurbanleague.com/Home/tabid/40/EntryId/1345/The-One-Percent.aspx

My girlfriend drives 65 miles one way for a $40,000/year job with a 1:1 salary:debt ratio. And she is happy to do it since its a job. She couldn’t find work for 2 months of 40 hours a week putting in applications (live in Mich, job market sucks) I’m a student with no income and loans who can’t work due to doing 60 hour weeks for school.

The girl in the picture can STFU. And find a cheaper place to live.

“Single, $52K per year and she’s whining? Poor baby. I know whole families who are eating, keeping a roof over their heads, and clothing everyone for a lot less than that.”

I am one of those families! I wish I made 52K! It’s late, I’m grumpy, I gotta work tomorrow, so does my wife, but I’d buy tickets to see people like this smacked with a clue-by-four.

But, my bills are paid, my cars run, the technology works, and there’s even ammo for the firearms. Hey, a plan can work wonders.

Her commute is 65 miles DAILY. That’s about 30 miles each way. I don’t consider that to be a horrible commute.

another thing – I don’t think she actually has a 35% overall tax liability. Strip out social security and medicare, and she is looking at 28%, Her fed tax liability is low (around 10-15% overall) when she is done and even then, she gets a nice refund check I am sure. she just needs to move from NJ to make up the difference

Dude, she makes $52k/year or $4,333/month. If she brings home $3,200/month that works out to a max of 26% tax rate.

And that’s only if she get’s paid twice a month and isn’t insured. If she is paid biweekly she grosses only $4k/month which is a 20% tax rate.

If she takes advantage of her employers healthcare plan (let’s say she has a High Deductable plan for herself only) that’s another $100/month or so which reduces her taxes to just 17.5%.

Well there’s her problem: SHE CAN’T DO MATH!

And kenno dude, speechifyin’ that you want to vote in communists isn’t insurrection. It’s stupid, but it ain’t Treason.

When they start picking up guns and shooting people, maybe. But standing in the street proclaiming your stupidity to one and all is hardly a “capital offense”.

“At $52k/yr, she’s earning more than the average HOUSEHOLD in the US, which recent numbers put at $49k and change.”

True, but any statistician will tell you that using averages for incomes is a horrible idea because they’re dominated by upper end outliers. I live in the I95 NY-DC corridor. The median household income for my zip code is $30k above the national average. And I don’t live in an especially affluent area, I live in a boring suburban section of northern Delaware. That extra income means higher market prices for all sorts of daily expenses, especially necessities like housing/real estate.

Yes she needs to rework her expenses. Get a roommate and all the housing expenses will drop by 40%. Carpool, use public transport, or just trade in for a more modest lightly-used car and a commuter pass. Seriously, I have a longer commute with the same toll rate, but I’ve never paid what she does in gas/tolls/car payments.

I think $49k, actually is the median and not the mean.

[statistician]Technically, the mean, median, and mode are all considered “averages”.[/statistician]

My response:

I’m 29 years old with a BS.

Days after graduating high school, I took a job as a temporary laboror in a steel factory and saved up enough money to pay for my first year of college.

I spent the next six years earning a four year degree, taking semesters off so I could work and save money for tuition. During those six years, I spent twice as much time serving internships, networking, and doing independent-study than I ever spent on classwork. I was the only person in my major (out of about 200) to have a job offer, upon graduation, before my senior year even started.

After graduation I got married; the combined debt of my wife and I was $70,000 in student loans and $7,000 in credit cards. I took a job paying $30K/yr., half of what many of my peers were making, because I knew I would learn much and saw great opportunity. On this salary, I supported myself and my wife, who was still in school, and paid off our credit cards in one year. The company I was working for folded, and I lost my job.

My wife finished school, and we moved 2000 miles so she could work for the Air Force. I got a job with a major aerospace company. We lived on her salary, and used ALL of mine to eradicate our debt. Within 2 years, our student loans were gone. We moved again, 1300 miles.

I found a job with a green-tech start-up. Still living off of one salary, we bought a $130K house with the second. The mortgage is the only debt we have. After 18 months, I quit my job and started my own consulting company. People told me I was crazy to leave a stable job in this economy. I nearly doubled my salary in the first year. Two years later, we are putting a $100K down payment on a $230K house. We can afford to keep the first house as an investment property.

Because of my business, I’ve been offered a full-time job in our home town. We’re about to move a third time, another 1300 miles. With the salary at my new job, my wife can fulfill her wish of being a stay-at-home mom for our (soon to be) first born.

I have paid cash for every vehicle I have ever owned.

I have exactly one credit card, with a $0 balance.

I realize that a degree guarantees no job, and promises no salary. Only I have that ability.

IF YOU ARE THE 99%,

I PROUDLY CALL MYSELF THE 1%

Jason:

Congratulations!

http://chzmemebase.files.wordpress.com/2011/10/internet-memes-dat-wallstreet.jpg

These two should hook up.

At 26 I was making 2/3 of that and able to live in NJ. I had a paid for car, basic cable because it was cheaper than getting naked internet from Comcast, and a roommate. My advise to her is to sell the car, cut the cable bill, and quit eating out.

I think the thing that really kills me is I’m currently surviving on about what this chick makes, and I have a mortgage that’s nearly double her rent. If I paid 1000 a month for my mortgage, I’d make it on what she’s taking home, with a little to spare.

The student loan issue, and the huge taxes, are the only things I sympathize with. Yet, how many of these “Occupiers” are wiling to lay the blame on government for these things? None: they assume Wall Street is all to blame.

Nor will they blame “Big Ed”, which has fueled the need for more and more student loans, and have all the while, selling the lie that “all you need is a degree–the higher, the better–and you’re set!” The problem, though, is that “Big Ed” is in cahoots with “Big Gov”, which supports this occupation thing.

I would admit that I was blinded by the promises–I personally wracked up over $100,00 in student loans–and while realize that much of this was my fault, I also lay blame on the Education Establishment, and on Big Business. Wall Street had nothing to do with my decisions to pursue education debt!

Sounds like she values living/working in New York (or equivalent; I could do some research for figure out where heavy bridge tolls and that length of commute and those rent figures are plausible, but let’s just assume some Big Urban Area back east as most likely) more than having any money left over in her paycheck.

The government doesn’t need to fix her problems. She needs to, and can. A few lifestyle changes will easily let her afford health insurance, fer instance, as others have already noted.

There are people I have sympathy for, for their bad financial situations.

She is not one of them.

Could be living in CT while working in NYC. Connecticut I’d outrageously expensive. $50K does not go far there.

San Francisco is another place where money doesn’t go far.

Sucks to be you. Move closer to work, sell your car, with that you drop the insurance, find a place to rent that is cheaper and includes utilities and roaches.

Bingo, mo money, mo money, whoo hoo, I hit the money train!!!

And if 35% of your pay goes to taxes, I will kiss your a$$!!